1. What is a trust fund?

2. How do trust funds work?

3. Who can create a trust fund?

4. What assets can be placed in a trust fund?

5. What are the benefits of a trust fund?

6. What are the risks of a trust fund?

7. How to choose a trustee for a trust fund?

8. How to set up a trust fund?

9. How to manage a trust fund?

10. FAQ

* trust fund

* estate planning

* inheritance

* financial planning

* gift taxes

Informational

People who search for “what are trust funds” are looking for information about what a trust fund is, how it works, and who can benefit from one. They may be interested in learning more about the tax implications of a trust fund, or how to set one up.

| Topic | Answer |

|---|---|

| What is a trust fund? | A trust fund is a legal agreement that allows one person (the settlor) to give assets to another person (the beneficiary) for a specific purpose. |

| How do trust funds work? | The settlor transfers ownership of assets to the trustee, who then manages the assets for the benefit of the beneficiary. |

| Who can create a trust fund? | Any person who is 18 years of age or older can create a trust fund. |

| What assets can be placed in a trust fund? | Any type of asset can be placed in a trust fund, including cash, stocks, bonds, real estate, and intellectual property. |

What is a trust fund?

A trust fund is a legal arrangement in which one person (the settlor) transfers assets to another person (the trustee) for the benefit of a third person (the beneficiary).

3. What is a trust fund?

A trust fund is a legal arrangement in which one person (the settlor) transfers assets to another person (the trustee) to hold and manage for the benefit of a third person (the beneficiary).

Trust funds can be used for a variety of purposes, such as providing for the education of children, funding a retirement, or preserving assets for future generations.

Trust funds can be either revocable or irrevocable. A revocable trust can be changed or terminated by the settlor at any time, while an irrevocable trust cannot be changed or terminated without the consent of the beneficiary.

Trust funds are often used as a way to avoid probate, which is the legal process of transferring assets from a deceased person’s estate to their heirs. When a trust is created, the assets are transferred to the trustee, who then manages them for the benefit of the beneficiary. This means that the assets in the trust do not pass through the settlor’s estate and are not subject to probate.

What is a trust fund?

A trust fund is a legal arrangement in which one person (the settlor) transfers assets to another person (the trustee) to hold and manage for the benefit of a third person (the beneficiary).

Trust funds can be used for a variety of purposes, such as providing financial support for a child’s education, funding a retirement, or leaving a legacy to future generations.

Trust funds can be either revocable or irrevocable. A revocable trust can be changed or terminated by the settlor at any time, while an irrevocable trust cannot be changed or terminated without the consent of the beneficiary.

Trust funds are often used as a way to avoid probate, which is the legal process of distributing a deceased person’s assets after their death. When a trust is created, the assets are transferred to the trustee, who then manages the assets for the benefit of the beneficiary. This means that the assets in the trust are not subject to probate, which can save time and money.

Trust funds can also be used to provide for beneficiaries who are minors or who have special needs. In these cases, the trustee can manage the assets in the trust in a way that is most beneficial to the beneficiary.

Trust funds can be a valuable tool for estate planning and wealth management. They can provide financial security for beneficiaries and can help to avoid probate. If you are considering creating a trust fund, it is important to speak with an experienced estate planning attorney to discuss your options.

What are the benefits of a trust fund?

There are many benefits to having a trust fund, including:

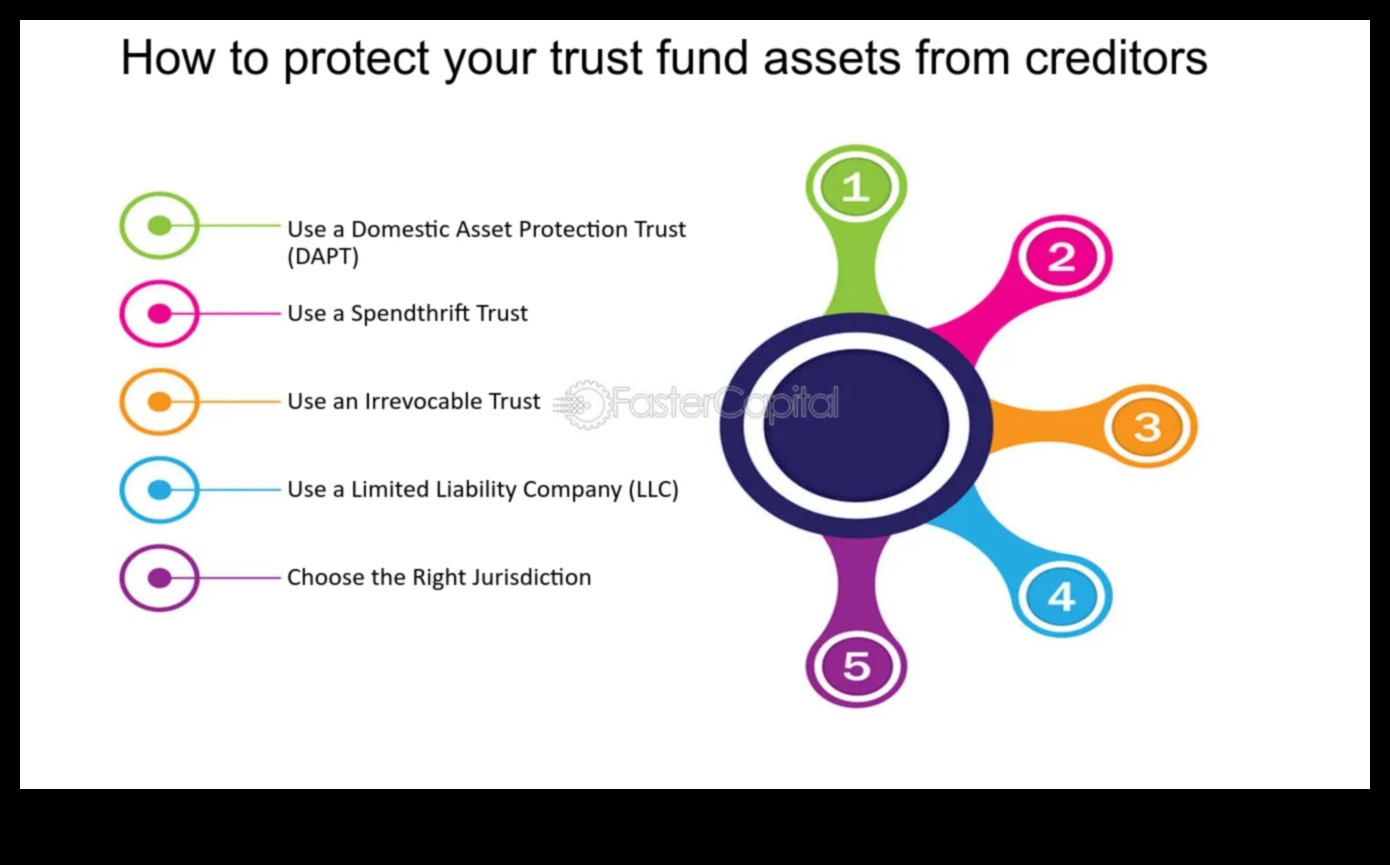

- Protecting assets from creditors and lawsuits

- Minimizing taxes

- Providing for the education and care of children

- Continuing a family business

- Passing on wealth to future generations

Trust funds can be customized to meet the specific needs of the settlor and beneficiaries, and can provide a great deal of flexibility and control over how assets are used.

If you are considering creating a trust fund, it is important to work with an experienced estate planning attorney to ensure that the trust is structured in the most tax-efficient manner and that it meets your specific goals.

6. Risks of a trust fund

There are a number of risks associated with trust funds, including:

- The trust may not be managed properly. This could lead to the trust assets being invested poorly or lost altogether.

- The trustee may not act in the best interests of the beneficiaries. This could lead to the trustee using the trust assets for their own personal benefit, or making decisions that are not in the best interests of the beneficiaries.

- The trust may be subject to taxes. Trusts can be taxed at both the federal and state levels.

- The trust may be subject to legal challenges. If someone challenges the validity of the trust, it could be dissolved and the assets distributed to the beneficiaries.

It is important to be aware of these risks before you decide to create a trust fund. If you are concerned about any of these risks, you should speak to an experienced estate planning attorney.

How to choose a trustee for a trust fund

Choosing a trustee for a trust fund is an important decision that should be made carefully. The trustee will be responsible for managing the trust fund according to the terms of the trust agreement, and they will have a significant impact on the lives of the beneficiaries.

There are a few things to consider when choosing a trustee, including:

- The trustee’s qualifications and experience

- The trustee’s ability to work independently and impartially

- The trustee’s relationship with the settlor and beneficiaries

- The trustee’s willingness to serve

The settlor of the trust may choose a single trustee, or they may choose to have multiple trustees. If there are multiple trustees, they will typically work together as a team to manage the trust fund.

In some cases, the settlor may choose to appoint a corporate trustee, such as a bank or trust company. Corporate trustees are often experienced in managing trust funds, and they can provide a level of objectivity and independence that may not be available from a family member or friend.

Once a trustee has been chosen, the settlor should document their decision in the trust agreement. The trust agreement should clearly state the trustee’s duties and responsibilities, as well as the settlor’s expectations for the trustee’s performance.

Choosing a trustee is an important decision that should not be taken lightly. By carefully considering the factors listed above, you can help to ensure that your trust fund is managed in a responsible and efficient manner.

How to set up a trust fund

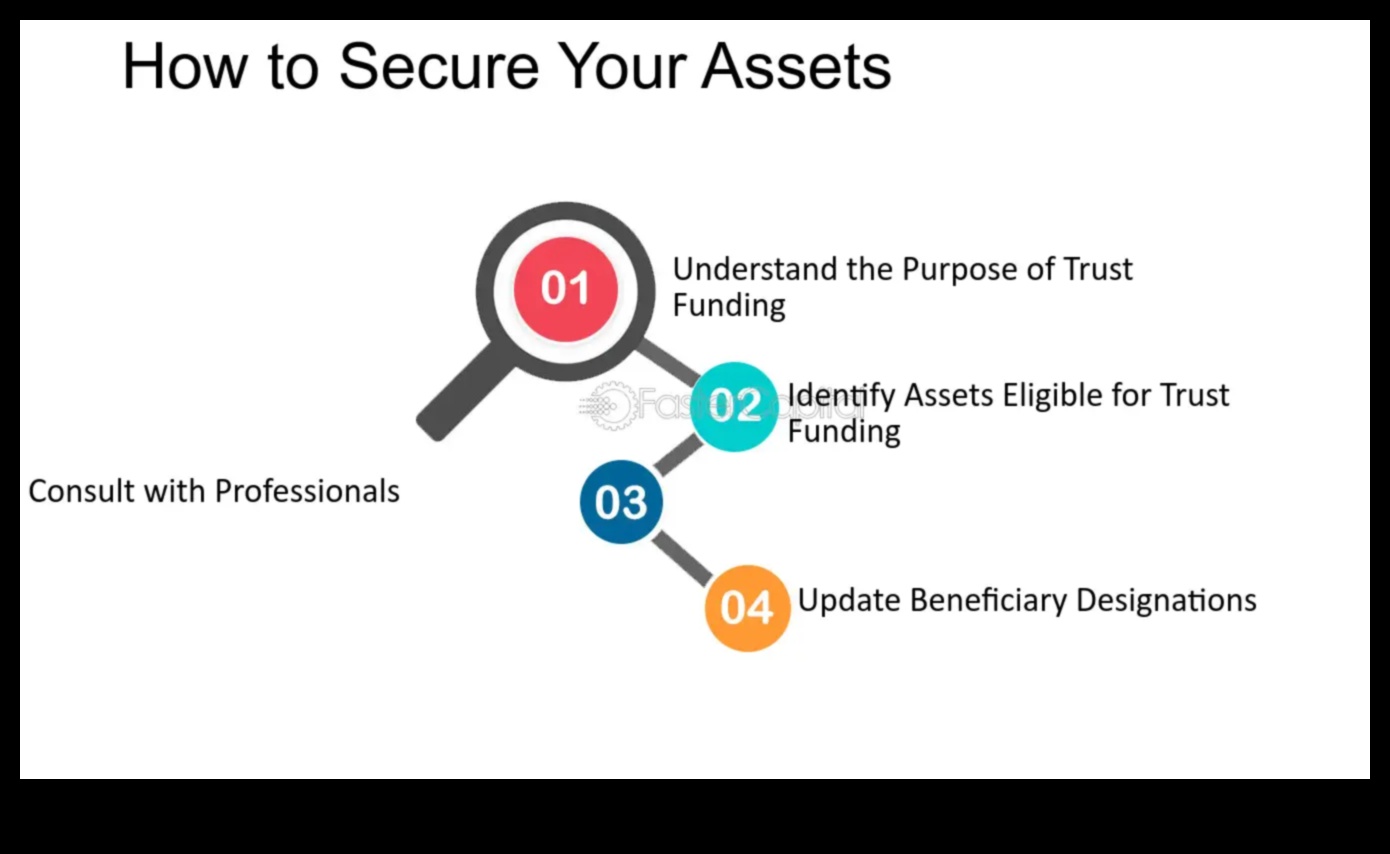

Setting up a trust fund can be a complex process, but it can be a valuable way to provide for your loved ones and manage your assets. Here are the steps involved in setting up a trust fund:

- Decide what type of trust you want to create. There are many different types of trusts, each with its own set of rules and benefits. Some of the most common types of trusts include:

- Revocable living trusts

- Irrevocable living trusts

- Testamentary trusts

- Charitable trusts

- Choose a trustee. The trustee is the person or organization responsible for managing the trust fund. It is important to choose a trustee who is trustworthy, reliable, and has the financial expertise to manage the trust fund.

- Fund the trust. The trust fund must be funded with assets, such as cash, stocks, bonds, or real estate. The amount of assets you contribute to the trust will determine the size of the trust fund and the amount of income it will generate.

- Draft the trust document. The trust document is a legal document that sets out the terms of the trust. It includes information such as the trustee’s duties, the beneficiaries of the trust, and the distribution of assets upon the termination of the trust.

- Register the trust. In most states, trusts must be registered with the state government. This process typically involves filing a form with the state’s secretary of state’s office.

Setting up a trust fund can be a complex process, but it can be a valuable way to provide for your loved ones and manage your assets. If you are considering setting up a trust fund, it is important to consult with an experienced estate planning attorney.

How to manage a trust fund

A trust fund is a legal arrangement in which a trustee holds assets for the benefit of another person or entity (the beneficiary). Trust funds can be used for a variety of purposes, such as providing financial support for a child, paying for educational expenses, or funding a retirement.

Trust funds are typically managed by a trustee, who is responsible for investing the trust assets and distributing the income and principal to the beneficiary in accordance with the terms of the trust agreement. The trustee may also be responsible for managing the trust’s day-to-day operations, such as paying bills and filing taxes.

There are a number of factors to consider when managing a trust fund, including:

- The purpose of the trust

- The age and needs of the beneficiary

- The tax implications of the trust

- The investment strategy for the trust

- The management of the trust’s day-to-day operations

If you are considering creating a trust fund, or if you are a trustee of a trust fund, it is important to work with an experienced attorney to ensure that the trust is structured properly and that it is managed in accordance with the law and the wishes of the settlor.

FAQ

Q: What is a trust fund?

A: A trust fund is a legal arrangement in which one person (the settlor) transfers assets to another person (the trustee) for the benefit of a third person (the beneficiary).

Q: How do trust funds work?

A: The trustee manages the trust assets for the benefit of the beneficiary. The trustee can invest the assets, pay for the beneficiary’s expenses, and make distributions to the beneficiary as needed.

Q: Who can create a trust fund?

A: Anyone who is legally competent can create a trust fund. This includes individuals, businesses, and charitable organizations.