What Jobs Can I Get With a Bachelor’s in Finance?

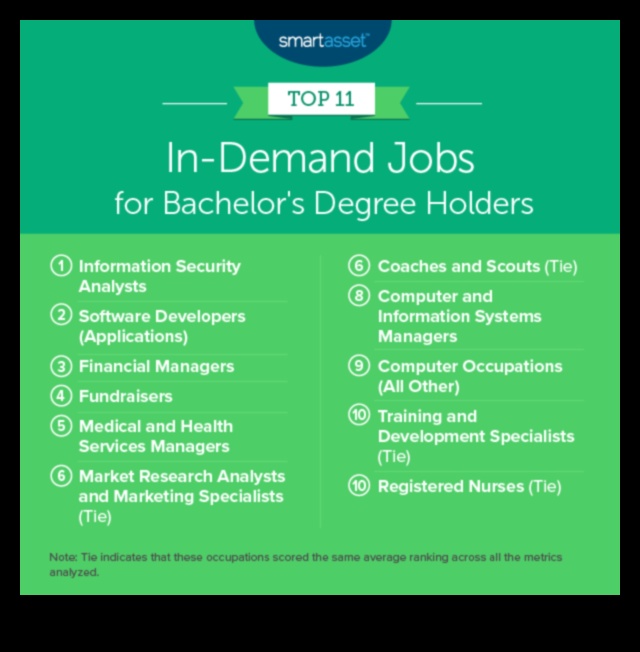

A bachelor’s degree in finance can open up a wide range of career opportunities in the financial services industry. Here are some of the most common types of finance jobs that you can get with a bachelor’s degree:

- Financial analyst

- Investment banker

- Portfolio manager

- Credit analyst

- Risk manager

- Financial planner

- Accountant

- Auditor

- Tax preparer

The specific job titles and duties that you will have will vary depending on the industry you work in and the size of the company you work for. However, all finance jobs require a strong understanding of financial concepts and principles, as well as the ability to work independently and as part of a team.

In addition to a bachelor’s degree in finance, many employers also require candidates to have a certain number of years of experience in the financial services industry. Some finance jobs also require candidates to pass a licensing exam, such as the Chartered Financial Analyst (CFA) exam or the Certified Public Accountant (CPA) exam.

The salary potential for finance jobs varies depending on the industry, the company, and the level of experience. However, finance jobs typically offer competitive salaries and benefits. According to the Bureau of Labor Statistics, the median annual salary for financial analysts was $81,160 in 2020. The median annual salary for investment bankers was $110,050 in 2020.

The job outlook for finance jobs is expected to be strong in the coming years. The Bureau of Labor Statistics projects that employment in the financial services industry will grow by 10% from 2020 to 2030, faster than the average for all occupations.

If you are interested in a career in finance, a bachelor’s degree in finance is a great place to start. With a strong foundation in financial concepts and principles, you will be well-prepared for a wide range of finance jobs.

| Feature | Answer |

|---|---|

| Finance jobs | There are many different types of finance jobs, including financial analyst, investment banker, portfolio manager, and credit analyst. |

| Bachelor’s in finance | A bachelor’s degree in finance is the most common educational requirement for finance jobs. |

| Career opportunities in finance | The finance industry offers a wide range of career opportunities, with many different types of jobs available at all levels of experience. |

| Financial analyst | A financial analyst is responsible for analyzing financial data and providing insights to help businesses make informed decisions. |

| Investment banker | An investment banker is responsible for advising clients on mergers and acquisitions, raising capital, and issuing securities. |

II. Types of Finance Jobs

There are a wide variety of finance jobs available, each with its own unique set of responsibilities and requirements. Some of the most common types of finance jobs include:

- Financial analysts

- Investment bankers

- Portfolio managers

- Credit analysts

- Risk managers

- Wealth managers

- Fund managers

- Accountants

- Auditors

Each of these jobs requires a different set of skills and qualifications, so it’s important to do your research and make sure that you’re pursuing a job that’s a good fit for your skills and interests.

II. Types of Finance Jobs

There are a wide variety of finance jobs available, each with its own unique set of responsibilities and requirements. Some of the most common finance jobs include:

- Financial analyst

- Investment banker

- Portfolio manager

- Credit analyst

- Risk manager

- Fund manager

- Securities trader

- Financial advisor

- Accountant

These are just a few of the many finance jobs that are available. The specific type of finance job that you pursue will depend on your interests, skills, and qualifications.

IV. Skills Needed for Finance Jobs

In addition to a strong academic foundation in finance, there are a number of skills that are essential for success in a finance career. These skills include:

- Analytical skills

- Problem-solving skills

- Communication skills

- Interpersonal skills

- Mathematical skills

- Technical skills

Analytical skills are essential for being able to identify and solve problems in the financial world. Problem-solving skills are also essential, as finance professionals are often faced with complex problems that require creative and innovative solutions. Communication skills are important for being able to effectively communicate with clients, colleagues, and other stakeholders. Interpersonal skills are also important for being able to work effectively in teams and build relationships with clients. Mathematical skills are essential for being able to understand and analyze financial data. Technical skills are also important, as finance professionals often need to use specialized software and systems to do their jobs.

By developing these skills, you can increase your chances of success in a finance career.

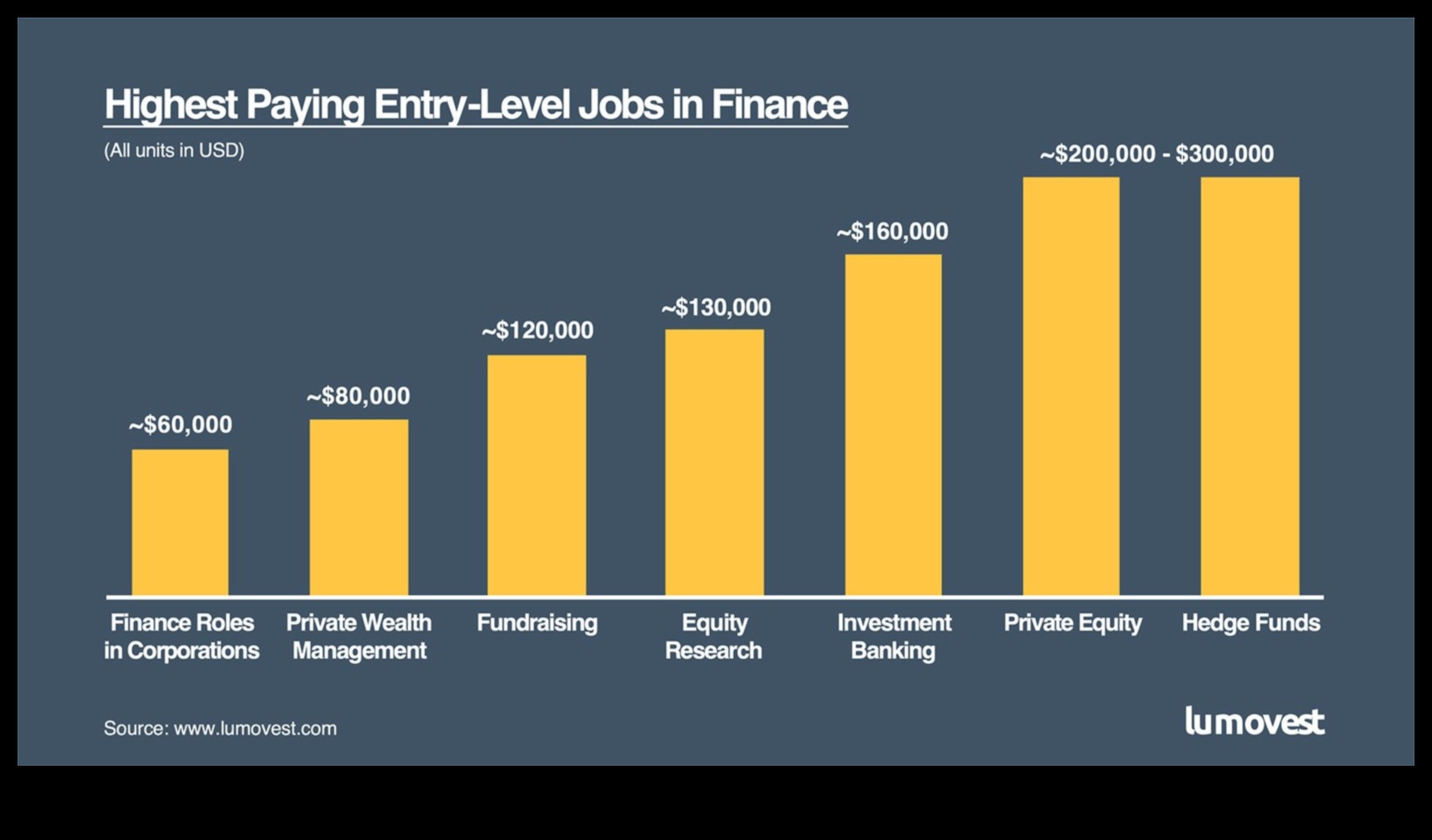

Salary Expectations for Finance Jobs

The median annual salary for finance professionals is $81,530, according to the Bureau of Labor Statistics. However, the salary range for finance jobs can vary significantly depending on the specific job title, level of experience, and location. For example, financial analysts typically earn a median salary of $74,890, while investment bankers earn a median salary of $115,320.

The following table provides a more detailed look at the salary range for some of the most common finance jobs:

| Job Title | Median Annual Salary |

|---|---|

| Financial Analyst | $74,890 |

| Investment Banker | $115,320 |

| Portfolio Manager | $103,740 |

| Financial Advisor | $86,710 |

| Credit Analyst | $68,230 |

It is important to note that these are just average salaries and your actual earnings may vary depending on your individual skills and experience.

VI. Job Outlook for Finance Jobs

The job outlook for finance jobs is generally positive. According to the Bureau of Labor Statistics, employment in the finance industry is expected to grow by 6% from 2020 to 2030, faster than the average for all occupations. This growth is expected to be driven by the increasing need for financial professionals in a variety of industries, including banking, insurance, and investment management.

Specifically, the following finance jobs are projected to have the highest growth rates over the next decade:

- Financial analysts

- Investment bankers

- Personal financial advisors

- Portfolio managers

- Risk managers

These jobs offer a variety of opportunities for people with a bachelor’s degree in finance. Financial analysts typically work for banks, investment firms, or other financial institutions. They provide financial advice to clients and help them make investment decisions. Investment bankers work on mergers and acquisitions, and help companies raise capital through initial public offerings (IPOs). Personal financial advisors help individuals manage their finances and plan for retirement. Portfolio managers oversee investment portfolios and make investment decisions on behalf of clients. Risk managers assess the risks associated with investments and develop strategies to mitigate those risks.

The median annual salary for finance jobs is $81,550, according to the Bureau of Labor Statistics. However, salaries vary significantly depending on the specific job title, level of experience, and employer.

Overall, the job outlook for finance jobs is positive. There are a variety of high-paying finance jobs available for people with a bachelor’s degree in finance.

VII. Tips for Getting a Finance Job

Here are some tips for getting a finance job:

- Network with people in the finance industry.

- Get involved in extracurricular activities related to finance.

- Build your skills and knowledge in finance.

- Get internships and other work experience in finance.

- Prepare for interviews by practicing your answers to common interview questions.

- Tailor your resume and cover letter to each job you apply for.

- Be persistent and don’t give up.

Common Interview Questions for Finance Jobs

Here are some common interview questions for finance jobs:

- Why do you want to work in finance?

- What are your strengths and weaknesses?

- What is your financial knowledge?

- What is your experience with financial modeling?

- What is your experience with financial analysis?

- What is your experience with financial reporting?

- What is your experience with financial decision-making?

- What are your salary expectations?

- What are your career goals?

IX. Resources for Finance Jobs

Here are some resources that you can use to find finance jobs:

You can also find finance jobs by attending job fairs and networking with people in the finance industry.

FAQ

Q: What are the different types of finance jobs?

A: There are many different types of finance jobs, including:

- Financial analyst

- Investment banker

- Portfolio manager

- Credit analyst

- Risk manager

Q: What education do I need to get a finance job?

A: A bachelor’s degree in finance is the minimum educational requirement for most finance jobs. However, some employers may prefer candidates with a master’s degree in finance or a related field.

Q: What skills do I need for a finance job?

A: The skills you need for a finance job will vary depending on the specific role you are applying for. However, some of the most common skills required for finance jobs include:

- Strong analytical skills

- Excellent communication skills

- Problem-solving skills

- Financial modeling skills

- Data analysis skills